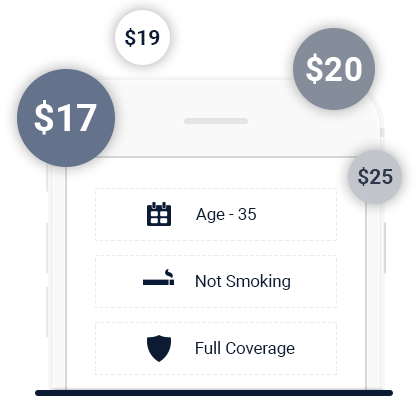

Compare Affordable Health Insurance Plans!

Join Millions of People Saving:

Get Pretected In 3 Simple Steps:

Tell us a little bit about yourself to create a unique consumer profile.

Get matched with tailor-made results and compare between the best possible policies.

Make an educated choice as we make sure you save time and money!

You Don't Have To Pay More To Get The Best Treatment

Being Ready Before It Happens Will Save You a Lot Of Money!

No one wants to think about bad things happening, we understand. But the harsh reality is that if you or one of your family members get sick or injured and you are not properly insured, it is going to cost you a fortune.

There are 4 important points to take notice to when considering yourself "properly insured":

1. You actually have a current active health insurance policy.

2. You have made sure that your specific plan is fit to your unique needs and condition.

3. Your health insurance plan covers all main illness and injury.

4. Your plan has the widest possible coverage while remaining affordable.

The Most Important Thing To Remember:

Always keep yourself educated and knowledgeable regarding your health insurance policy. As we grow older, our health status significantly changes and it is crucial we maintain a health plan that can cater to all current and future conditions. Forgetting to update or switch plans can result in tremendous medical bills which could have been reduced to nearly nothing were you to have the right coverage.

Comparing between online health insurance plans with Pretected is the best way to make sure you have the best possible healthcare options as well as not paying over-inflated prices for unnecessary plans. We recommend that you check at least a few options to increase the chances of having a full and secure coverage for you and your family. With Pretected you can compare insurance companies, rates, plans, coverage and many more specific details to create your own perfect health plan! **

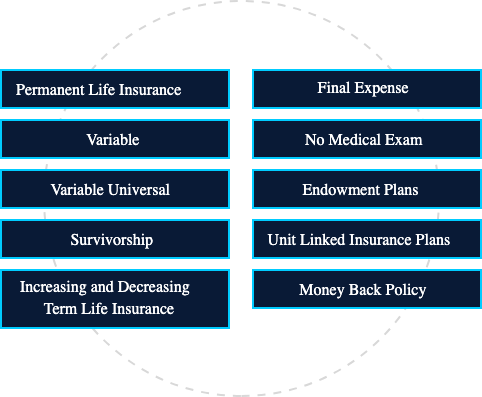

Understanding Your Medical Insurance Options Leads To A Better And Less Expensive Plan

These are the most common types of health insurance plans. Please take the time to familiarize yourself with the differences between them so you can choose the one that suits your needs and comfort the most.

What Makes Pretected Different?

Most insurance comparison sites don't even take into consideration all of the valuable information you input online. All they end up doing is selling your contact details to the highest bidder regardless of the end result. We believe that is a complete waste of time and even more so a betrayal of confidence. If you have enough faith in Pretected to provide us with your personal information, the least we should do is guarantee a valid service, and we do so much more!

What Do We Do?

Our proprietary "smart matching" system collects thousands of data points from every connection made through our online platform and learns the compatibility level between every consumer and its possible future insurer.

Bearing in mind that each client is unique, our technology differentiates between over 50 data points creating a clear, singular client profile. The client profile data assets range between information donated by the user itself to information generated from public sources (statistical analytics).

We then match the consumer with the most compatible insurance options to make sure we maintain value and affordability.

Bottom Line:

If a policy is not good for the customer or he can't save money with it, we don't show it. Our software learns the significance of patterns and is able to foresee repetition and turn it into prediction. We get the right policy for each individual consumer. The high level of precision used to link each customer with its desired insurance policy serves the specific needs of both sides. In plain English… it's a WIN-WIN!